san francisco sales tax rate breakdown

Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. San francisco sales tax rate breakdown.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

1850000 Last Sold Price.

. 3900000 Last Sold Price. The California state sales tax rate is currently. The County sales tax rate is 025.

San francisco sales tax rate breakdown Sunday March 20 2022 Edit. San Francisco is in the following zip codes. California City County Sales Use Tax Rates How Do State And Local Sales Taxes Work Tax Policy Center.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. This includes the rates on the state county city and special levels. Albuquerque balloon fiesta chasers club tickets.

Californias base sales tax is 725 highest in the. San Francisco County CA Sales Tax Rate San Francisco County CA Sales Tax Rate The current total local sales tax rate in San Francisco County CA is 8625. The December 2020 total local sales tax rate was 8500.

The December 2020 total local sales tax rate was 8500. Limited to 15 per year on the minimum base tax 30 per year on. San Francisco has parts of it located within San Mateo County.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. The current total local sales tax rate in San Francisco CA is 8625. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Nearby homes similar to 1528 - 1530 20th St have recently sold between 1325K to 3900K at an average of 735 per square foot. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. SOLD MAY 2 2022.

The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. This is the total of state county and city sales tax rates. 521 Linden St San Francisco CA 94102.

This scorecard presents timely information on economy-wide employment indicators real estate and tourism. The transient occupancy tax is also known as the hotel tax. Parker county shooting today.

The December 2020 total local sales tax rate was 8500. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. File Monthly Transient Occupancy Tax Return.

The current total local sales tax rate in san francisco ca is 8625. The minimum combined sales tax rate for San Francisco California is 85. Sales Tax Breakdown San Francisco Details San Francisco CA is in San Francisco County.

The December 2020 total local sales tax rate was 8500. There is no applicable city tax. Biology a2 textbook pdf.

2022 Estimated Income Tax Rates And Standard Deductions Cpa Practice Advisor Sales Tax By State Is Saas Taxable Taxjar. Sales tax does not apply to Aviation Gasoline used to propel aircraft except for Aircraft Jet Fuel when the purchaser presents the Exemption Certificate for Motor Vehicle Fuel for Propelling Aircraft found in Regulation 1598 Motor Vehicle and Aircraft Fuels. Ad Standardize Taxability on Sales and Purchase Transactions.

94101 94102 94103. The 2018 United States Supreme Court decision in. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days.

The California sales tax rate is currently 6. The minimum combined 2022 sales tax rate for San Francisco County California is. Sales Tax Breakdown District Rate California State 7250 San Francisco County 1375 0000.

Average Sales Tax Summary The average cumulative sales tax rate in San Francisco California is 864. Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses. SOLD APR 5 2022.

Cities with an asterisk may fall within multiple. This is the total of state and county sales tax rates. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625. The current total local sales tax rate in san francisco ca is 8625. Automate Standardize Taxability on Sales and Purchase Transactions.

Therefore you will not be responsible for paying it. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The homeownership rate in san francisco ca is 371 which is lower than the national average of 641.

The San Francisco sales tax. The rates for Aircraft Jet Fuel are in the chart. The San Francisco County sales tax rate is.

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California Sales Tax Rate By County R Bayarea

2022 Property Taxes By State Report Propertyshark

Sales Tax Collections City Performance Scorecards

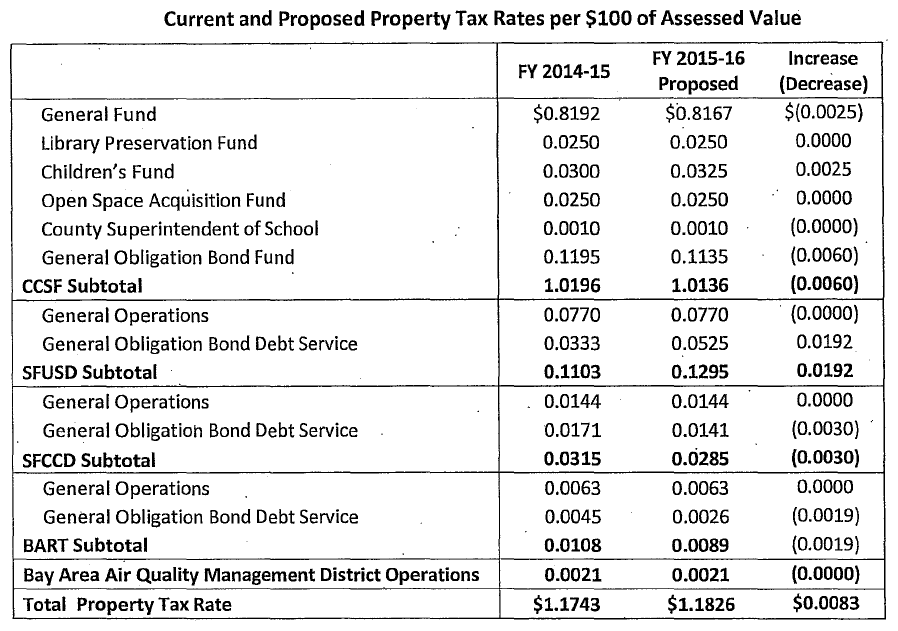

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

California City County Sales Use Tax Rates

Frequently Asked Questions City Of Redwood City

Understanding California S Sales Tax

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

Understanding California S Sales Tax

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate